Amid ongoing rumors of a state transportation funding bill being drafted in the Massachusetts State House, two broad coalitions of environmental justice and labor advocates have issued a detailed proposal to raise new revenues by closing corporate tax loopholes and getting a "fair share" from the large, profitable corporations that benefit most from an efficient transportation system.

In a report titled "Corporate Fair Share For Transportation," Raise Up Massachusetts and the Green Justice Coalition restate their longstanding support for a "fair share amendment," which would add four percentage points to the tax rate on individual incomes over $1 million.

The report also calls for the closure of loopholes for offshore tax havens, increasing the minimum corporate tax (which is currently only $456) for large companies, ending a narrow tax break for mutual fund companies, and better disclosure for corporate income to help policymakers evaluate the effectiveness of other tax loopholes.

The report estimates that these proposals could together generate over $2.4 billion a year, with the bulk of that new revenue coming from from the "fair share" income tax proposal.

To put that number in context, President Trump's 2017 tax law gave corporate profits a major tax windfall by cutting the federal tax rate from 35 to 21 percent; this report's authors estimate that Massachusetts companies gained a tax windfall worth $4 billion a year from those federal tax cuts.

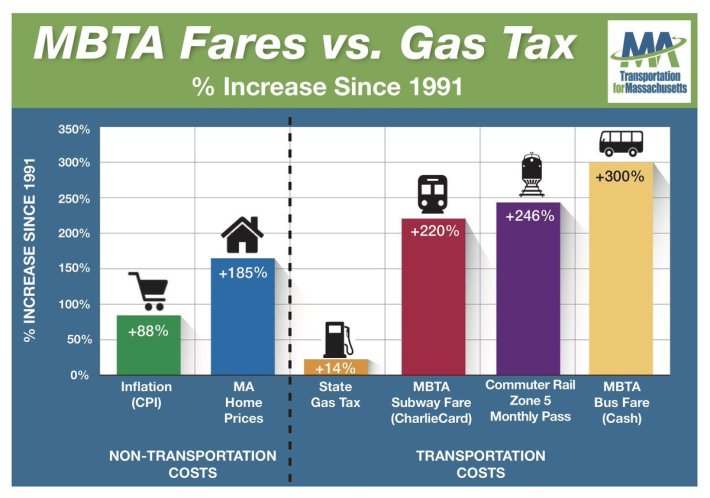

“From the legislators I've spoken with, there's a real recognition that user fees like gas taxes and transit fares disproportionately affect working families and low-income people," said Susanna Bohme, a researcher for Community Labor United, a Green Justice Coalition member. "We need to ensure that corporations pay their fair share.”

The report also specifies principles for how that new revenue should be used, with priorities given to reducing greenhouse gas emissions, making transit more affordable, and improving equity by improving transit service for lower-income neighborhoods and communities of color.

State House observers are still waiting to see a transportation funding proposal from legislative leaders after House Speaker Robert DeLeo missed a deadline to deliver a long-term plan for transportation investments last fall.